Just days after opening applications, the Payroll Protection Program (PPP) funding designed to help small businesses like you and me during the COVID-19 crisis, has run out of money.

Seriously?

I’ll admit when this funding was first mentioned, I was skeptical. Relieved, but skeptical. Regardless of my roller-coaster emotions and numerous opinions on COVID-19 and its mortality rate, epidemiology, and economic impact, I’ve been actively involved helping my small business clients navigate the murky waters of working remotely, how to market (and keep sane) in an ever-changing world, and even consulting on expense cuts since the shutdown began. After all, my former corporate America job was in accounting.

And just like you, I have spent countless hours reading, filling out forms, and collecting financial information (which was readily available since my ex-husband also believes my full financial history is his business, but I digress). As a small business owner, this is what I signed up for. It’s my responsibility to solve problems like these and keep food on the table of the rock stars that work with me – employees, consultants, and clients alike. I was okay with this constant uphill battle…until I read that Ruth’s Chris Steakhouse and Potbelly’s received $30 million in PPP funding! $30 million?!?!? These are both publicly held companies with over 5,000 employees EACH – how did they qualify for the small business Coronavirus aid?

The SBA classifies a small business as an INDEPENDENT business having fewer than 500 employees. You read that right….fewer than 500 employees.

But before screaming, I asked my small business owner contacts if they or anyone they knew had received funding. Nope. Not a soul.

Ruth’s Chris received PPP funding April 7, four days after the Small Business Administration opened the application window on its $350 billion Payroll Protection Program. I submitted a request to apply for the same loan on the same day with my bank, JPMorgan Chase, who ironically also happens to be the same bank that approved Ruth’s Chris and Potbelly. I filled out an online form with my name, phone number, and email address. After pressing submit, I was taken to a screen saying someone from the bank would call me. Don’t call them.

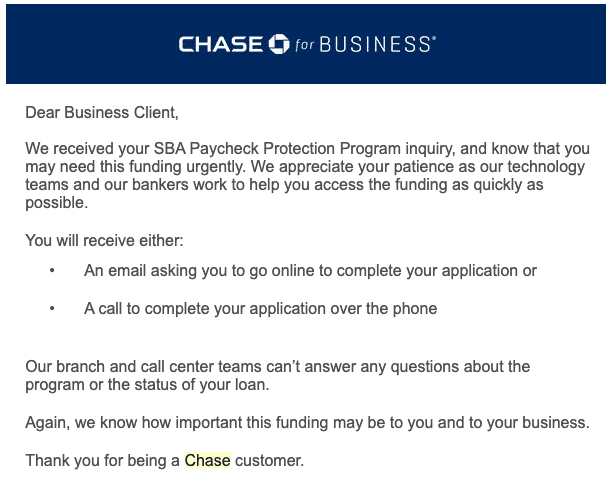

This is the email I received from JPMorgan Chase, my bank for over 20 years:

I didn’t like this confirmation, but I guess everyone is short-staffed right now. Not to mention this whole funding ordeal for the Coronavirus aid was being written in real-time. Things were changing everyday – the politicians were arguing, the banks were preparing and protecting themselves. The treasury was printing cash. I get it! The whole world is upside down and chaotic right now. I figured this process would take at least 30 days. So, I decided to be patient.

Fast forward to April 16 – just 13 days after the program opened – and $350 billion in small business funding has run out. Where did it go? And why so fast? Who knows if the Small Business Administration will disclose which companies received funding, but one thing is for sure – it’s not me, and it’s not my small business owner friends or their friends. It’s not the local restaurant. It’s not the gym or yoga studio. It’s not the hair or nail salon. It’s not your favorite little boutique on the corner. It’s not the new coffee shop.

So how does the parent company of Ruth’s Chris steak house that made $42 million in PROFITS last year and spent $41 million buying back stock and paying dividends apply for and receive $20 million in small business loans? $20 million, by the way, is TWO capped out loans under the PPP program!

Let’s assume a small business like yours or mine needs $20,000/month for payroll. Under the loan regulations that would have provided us $50,000 in relief (20,000 x 2.5 – the number of months the government thought we’d be shut down). If that same $30 million loan (Ruth’s Chris received $20M and Potbelly’s received $10M) had been given to save REAL small businesses that could have meant the difference of over 400 small business owners keeping their doors open and putting food on the table for thousands of families. But Courtney, you say, this loan could help the big steak houses pay the salaries of thousands of waitresses and waiters that have families, too. Ok, fair. But tell that to my mother who is a waitress at a local restaurant and had to file unemployment and is now “living” on $108 a week. That’s $464.40 a month ($108 x 4.3) in case you didn’t want to do that math yourself.

So what happened? How in the world did all the small businesses we know, love, and support not even get a first name greeting out of this? Well, mid-sized and large hotels and restaurants qualify for Payroll Protection Program funding because of a few “special rules” that were written into the CARES Act. There are always “special rules” when the government is involved, aren’t there?

You see, industry lobbyists argued that hospitality businesses would be devastated by the shutdowns and the stay-home orders. True. 100% true. These companies have twisted the Payroll Protection Program specifically created to help small businesses into a full-on corporate bailout. If a company has multiple locations and a gazillion employees, but not more than 500 per location – they’re eligible. Check out H. R. 748—8 of the CARES Act here. And with 1% loans, zero payments for six months, and the potential for loan forgiveness – who can blame them?

I am worried.

I am sad.

I am angry.

I am worried for my friends that own small retail shops and have had the fear of cooties laid upon them. (I mean, didn’t the circle-circle-dot-dot work for anyone?)

I am sad for the neighborhood restaurant that has laid off everyone except the cook in hopes to sell enough food just to pay the rent.

I am angry that the government, instead of placing warnings or restrictions on small businesses, forced many of us to close our doors with the promise that they would help us. A promise that gave us hope for 13 days. Just 13 days.

Hope will not keep the doors of my fellow business owners open. Hope will not pay the mortgage or rent of families. Hope will not put food on the table.

I don’t care whose fault this is. I don’t care what your position is on the virus or who you voted for.

But I do care about what is happening to our economy – to our lives. I care that we are being forced to not make ends meet. I care that our constitutional rights are being stripped from us. I care that the media – the news and social – are hyping up every single thing and causing mass hysteria. We are suffering. We are losing our retirement accounts, our savings, our homes. We have shut down our entire educational system. We have become prisoners in our own homes. We have become puppets to an extremely broken system.

Even if you’re not a small business owner, you should be angry with how this SBA loan played out in just 13 days. This WILL affect your community and your life. This WILL affect your taxes. The system is broken and a whole lotta things need to be fixed.

#rantover